Central Visayas Export Situationer

The following information was taken from a presentation for the RDC officers meeting this coming Friday which I and my officemate prepared for our boss.

Central Visayas exports (100% of which come from Cebu province) last year registered US$ 4.713 billion, a 13.50% increase over that of year 2004.

As can be seen in the slide, the region’s exports has had a double digit growth since year 2003. It took around five years for local exports to fully recover from the effects of the Thai baht collapse in 1997 which unleashed a wave of currency devaluations across Asia.

If you compare Central Visayas against the Philippines export performance, you can see that the region has fared better. In fact, share of region to total national exports is steadily increasing. Average export growth rate of the Philippines between years 2001-2005 is 6.42 percent; Central Visayas average is 12.1 percent for the same period.

Exports in the first semester this year is US$ 2.360 billion, a growth of 11.79% compared to the same period in 2005

As usual, electronic products and other industrial goods lead the list of top export performers in 2005.

The other product categories included in the top 10 list are furniture, garments, steel/metal products, electrical equipment, processed foods, marine product, vehicles and gifts, toys and housewares.

Although furniture hasn’t really reached its optimum performance, Cebu based firms had relatively better export sales compared to Metro Manila companies as gleaned from a survey conducted by Pearl 2, a Canadian International Development Agency.

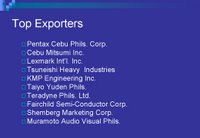

This slide shows the top exporters for year 2005. Most of them are electronics manufacturers.

Japan remains the top market for Central Visayas in year 2005 followed by United States, Hong Kong, Belgium, China, Indonesia, Korea, Netherlands, Singapore and Thailand.

Sectors that gained in year 2005 were steel/ metal products, chemicals, garments, fresh and frozen food products, processed food and agri/ forest products.

Sectors that declined in the same year were Electronics, Electrical Equipment, Packaging, Furniture, Gifts, Toys and Houseware, Fashion Accessories, Marine Products (except Carageenan), Mineral Products and Traditional Products.

Decrease in electronics in 2005 was attributed to high world oil prices and inflation which weakened consumer spending in US and Japan.

Exports growth of garments could be attributed to bulk orders of brassieres and children’s clothing (NSO).

Here are two of the exporters' concerns which, if addressed, could considerably improve the export performance of the region:

First is the strengthening of the peso. While the Arroyo Administration’s top economic team hail the appreciation of the local currency in recent months, the export industry sector, among others, bewail the dramatic rise of the Philippine peso to its record-high in 3 ½ years citing substantial losses which threaten the industry’s competitiveness.

The Cebu Furniture Industries Foundation said the ideal peso-dollar exchange level for exporters is from 53 to 54 pesos because most exporters do their quotation at this level. Beyond that, exporters will have their export revenues considerably diminished.

Second is loss of our competitive edge in design. Cebu is known as a design destination for the distinct look of its products which uses alternative natural materials for contemporary designs. In an increasingly competitive world, product design is critical. For the past few years, several of good Filipino designers have been pirated or have migrated to other countries. This situation adversely affected the quality and marketability of our products.

However, the Department of Trade and Industry is optimistic that exports in the region will further improve this year. Since 2004, IT and IT enabled services has been included in the region’s export statistics.

The agency expects this sector to surge further this year, as demand increases.

Based on statistical data, exports growth prospects of the region appear to be good. This optimism stems from the anticipated economic growth of the Philippines’ export markets such as Europe and Asia. Surprisingly, China has turned out to be the fastest growing export market of Central Visayas.

Another reason for the buoyant forecast is the increasing attention given to Cebu and its products with the series of high-profile international activities being held here.